With gold languishing around $1300/oz and Chinese Pandas trading below recent highs, it is time to re-look at the fundamental trends that have been driving the bull market.

A Brief History

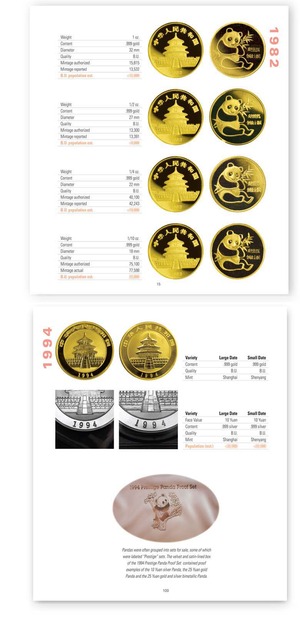

Let's begin with a little history. Back in 2005, the time I consider the beginning of the Chinese coin bull market, most Chinese gold and silver coins were trading just slightly above bullion melt value. Spot gold was trading near $430/oz, well above it's 2001 low near $260, and Pandas were just an interesting form of bullion. The only coin well above spot was a really nice 1982 1 oz, which I can remember buying for the outrageous price of $800! Everything else traded from +5% to perhaps +20% above spot.

Today, very few gem quality Pandas and other Chinese coins trade anywhere near spot. Only the most common panda dates, like 1987 and 2013, trade in lock-step with bullion. Many now trade at prices 3 to 4 times gold (see

earlier blog postings for examples). Paradoxically, many US gold coins, such as the famous $20 Gold Double Eagle and $10 Eagle, have barely kept up with bullion over the same time period. Why has this happened, and have the fundamental reasons changed?

American vs Chinese Style Investing

Back in the 1970s gold bull market, American investors who wanted gold had few choices. Double eagles, gold bars, Krugerrands, or perhaps a risky bet on a mining stock. The result was very high prices for desirable American coins. Today, Americans (and Europeans) have many paper-market investment opportunities, such has gold and silver ETFs, that absorb investor demand at the click of a mouse. Furthermore, westerners still trust their banking institutions and governments to honor the paper contracts for gold and silver, and to protect bank account savings from theft and fraud.

Chinese investors see the world quite differently. Banks and stock markets, while useful, represent substantial risk to the individual investor. Institutions are controlled by government and are subject to changing political winds and exposed to corruption. Too much visible wealth is dangerous and should be hidden. Tangible assets are now, and historically, the safest way to save and invest.

China's Response to US Monetary Policy

The flood of US dollars that has entered China over the last 15 years has created much wealth for the Chinese upper classes. However, the Chinese leadership appears to recognize that the uncontrolled expansion of US credit is unsustainable in the long term, so they have encouraged investment in tangible assets to counterbalance the risks intrinsic to the trillion dollars of US Treasuries they hold. Important examples include, China real estate, infrastructure investments, and massive purchases of African resources. And of course, massive imports of gold - in excess of 100 tons per month so far in 2013!

The above data only includes official imports from Hong Kong. There are certainly large quantities coming in via other, more private channels. China is clearly taking advantage of the current lower prices offered by the western futures markets.

The Niche Market for Panda Coins

The entire Panda coin market is tiny when compared to the tons of bulk metal being imported on a monthly basis. However, the economic forces driving the import of gold bars also underpin the Panda coins. These include the overt government promotion of gold coins as a investment for Chinese citizens, nationalist sentiments toward what is has become the signature gold and silver coin of China, and the desire to hold wealth in a portable, liquid, and private form. The strong private market demand was demonstrated by the success of the gold Panda Master Sets offered by Chinese banks, at $200K each, to wealthy customers last spring. Although that recent buying surge is done, there is no reason to believe that there will not be similar promotions in the future.

In recent news, the Chinese government has now further removed barriers to gold import. The

PBOC announced that

individuals can now import seven ounces of gold tax free and without reporting to customs. It seems like they are almost begging the people to buy gold coins!

The Fundamentals are Still Strong and the Trend is in Motion

The Chinese coin market is underpinned by key fundamentals

- Huge China demand for gold of all types

- Active promotion of gold by the Chinese government

- The desire of wealthy Chinese citizens for portable, private, wealth protection

- The ongoing currency war by the US Federal reserve

- The patriotic desire to own the official gold and silver coins of the nation

- Excellent past price performance will attract further speculation

- New tax relief for import of gold coins by individuals

- Very thin dealer inventories means few coins available to meet demand.

Speculative markets are known for having wild swings up and down - especially Chinese markets. Roller coasters are the norm. However, a collector who buys carefully and hangs on for the long haul is likely to be well rewarded.

Current year Chinese silver pandas usually sell for a few dollars more than Silver American Eagles. For example, 2014 BU 1 oz Silver Eagles are currently retailing for about $6 over spot while 2014 Silver 1 oz Pandas are about $9 over spot (single coin price, excluding shipping). This is because the China mint charges more for their coins than the US Mint, Panda mintages are lower, and demand for Pandas within China is seemingly insatiable

Current year Chinese silver pandas usually sell for a few dollars more than Silver American Eagles. For example, 2014 BU 1 oz Silver Eagles are currently retailing for about $6 over spot while 2014 Silver 1 oz Pandas are about $9 over spot (single coin price, excluding shipping). This is because the China mint charges more for their coins than the US Mint, Panda mintages are lower, and demand for Pandas within China is seemingly insatiable